Roberto Busby

👋 Hi, I'm a Data Analyst with experience in data manipulation, business intelligence, and process automation. I love turning complex data into insights that drive positive change.

Visit my LinkedIn

SQL at the Helm: Charting Financial Waters with World Bank Data

Table of Contents

Introduction

With a foundation in accounting and an interest in financial datasets, I was drawn to the World Bank’s data due to its breadth and complexity. The objective of this analysis is to navigate through this extensive dataset to unearth insightful financial patterns, assess the latest status of loans, and calculate obligations by various global borrowers using SQL queries.

Key Findings

- Predominant Financial Obligations in Kenya and Nigeria: Kenya and Nigeria are highlighted as the top countries with the highest financial obligations to the IDA, with Kenya leading at $7.5 billion.

- Active Transaction Hubs in South Asia: India, with the highest number of transactions (440), emerges as a central hub of activity within the World Bank’s financial network.

- Regional Financial Burdens and Service Charges: Europe and Central Asia region exhibit the highest average service charge rate (1.28%), indicating a more costly borrowing environment. Simultaneously, South Asia shows the highest total amount due ($591 billion).

Source

The dataset used in this analysis comes from the World Bank’s “IDA Statement of Credits and Grants Historical Data,” which is part of a comprehensive set of data services provided by the World Bank. It contains detailed financial information related to credits and grants administered by the International Development Association (IDA), which is a part of the World Bank focused on assisting the poorest countries. This dataset includes various metrics such as country, borrower, loan amounts, service charge rates, and status of the loans.

The dataset is publicly available and can be accessed via the World Bank’s finances website at World Bank IDA Credits and Grants.

Analysis

1. Data Inspection

- The dataset was acquired and loaded into a table using CSVFiddle.

- On initial inspection, it seemed there might be dupicate records. However, further investigation revealed that these were not duplicates but updates in the form of different snapshots over time.

- To ensure the analysis reflected the most current financial situation, I used a specifc SQL sub-query to filter the data:

WHERE "End of Period" = ( SELECT MAX("End of Period") FROM banking_data )

2. SQL Queries

Below are the SQL queries used in the project, each query is accompanied by its respective output image:

2.1 Top Borrowers and Their Amounts Due

Identify specific borrowers (typically government bodies or ministries of finance) with the highest amounts due, providing a clearer picture of responsibility and financial management at a more granular level within the countries.

SELECT

Borrower,

Country,

"Due to IDA" AS due

FROM

banking_data

WHERE

due IS NOT NULL

AND "End of Period" = (

SELECT

MAX("End of Period")

FROM

banking_data

)

ORDER BY

due DESC

LIMIT

10;

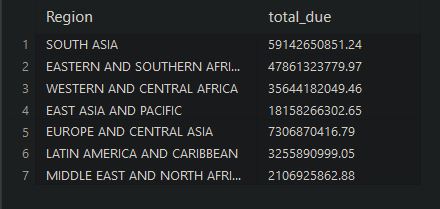

2.2 Total Amount Due by Region

Understand which regions have the largest total financial commitments due, indicating where the IDA’s financial resources are most heavily allocated.

SELECT

region,

ROUND(

SUM("Due to IDA"),

2

) AS total_due

FROM

banking_data

WHERE

"End of Period" = (

SELECT

MAX("End of Period")

FROM

banking_data

)

GROUP BY

region

ORDER BY

total_due DESC;

South Asia and Eastern and Southern Africa top this list, highlighting significant financial needs and engagements in these regions.

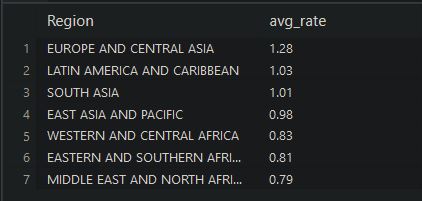

2.3 Average Service Charge Rates by Region

Explore and compare the average service charge rates across different World Bank regions, which can indicate the cost of borrowing and the financial terms set by the IDA across different geographies.

SELECT

region,

AVG("Service Charge Rate") AS avg_rate

FROM

banking_data

WHERE

"End of Period" = (

SELECT

MAX("End of Period")

FROM

banking_data

)

GROUP BY

region

ORDER BY

avg_rate DESC;

Regions like Europe and Central Asia exhibit higher rates, potentially pointing to varying economic conditions or risk assessments by the IDA.

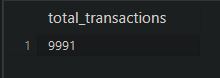

2.4 Total Transactions Overall:

Quantify the total number of transactions recorded in the latest dataset snapshot, offering a macroscopic view of the activity level across all countries with the IDA.

SELECT

COUNT(*) AS total_transactions

FROM

banking_data

WHERE

"End of Period" = (

SELECT

MAX("End of Period")

FROM

banking_data

);

With 9,991 transactions, the data reflect a high level of global engagement with the IDA, indicating extensive developmental efforts.

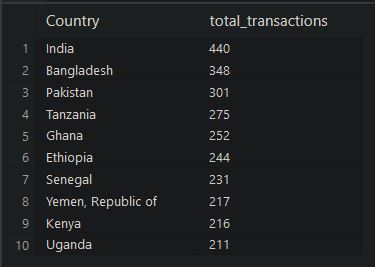

2.5 Total Transactions by Country:

Determine which countries have the highest number of transactions with the IDA, providing insight into which countries are most actively engaging with the World Bank in terms of the number of projects or financial interactions.

SELECT

country,

COUNT(*) AS total_transactions

FROM

banking_data

WHERE

"End of Period" = (

SELECT

MAX("End of Period")

FROM

banking_data

)

GROUP BY

country

ORDER BY

total_transactions DESC

LIMIT

10;

India, Bangladesh, and Pakistan are the most active, which might reflect their dynamic involvement in development projects financed by the IDA.

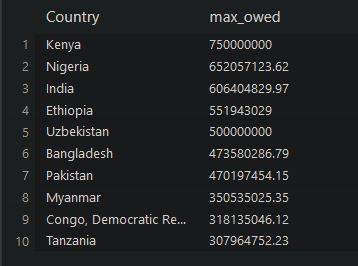

2.6 Maximum Amount Owed by Countries:

Identify which countries have the highest financial obligations to the IDA. This helps understand where the most significant financial interventions might be needed and which countries are under the heaviest debt burden.

SELECT

country,

MAX("Due to IDA") AS max_owed

FROM

banking_data

WHERE

"End of Period" = (

SELECT

MAX("End of Period")

FROM

banking_data

)

GROUP BY

country

ORDER BY

max_owed DESC

LIMIT

10;

Countries like Kenya and Nigeria top this list, highlighting their substantial financial commitments.

Conclusion

This analysis of the World Bank’s IDA data for 2022 provided crucial insights into the financial dynamics of countries and regions interacting with international development funds:

- Substantial Debts in Key Nations: Kenya and Nigeria emerged as countries with the most significant financial obligations to the IDA, indicating potential areas for focused economic support or debt relief interventions.

- High Engagement in Developmental Activities: Countries like India, Bangladesh, and Pakistan showed high numbers of transactions, illustrating their active participation in development projects. This suggests a robust engagement with the IDA in striving for economic development and poverty alleviation.

- Regional Financial Commitments: South Asia and Eastern and Southern Africa were identified as regions with the highest total amounts due, highlighting where the IDA’s efforts are most concentrated and perhaps where the needs are greatest.

- Varied Borrowing Costs: The analysis also revealed differences in service charge rates across regions, with Europe and Central Asia facing the highest rates, which could affect the terms of financial aid and loan agreements in these regions.

SQL’s capability to efficiently filter and analyze data over millions of records enabled me to uncover meaningful financial insights across various countries. The process highlighted the importance of data preparation and the power of SQL in extracting actionable insights from the World Bank’s extensive datasets.